Overview of a Critical Industry Under Strain

The rare earth industry stands as a cornerstone of modern technology and defense, yet it remains precariously dominated by a single player—China. With control over approximately 70% of global mining and 90% of processing, China’s grip on these critical minerals creates vulnerabilities for nations reliant on them for everything from smartphones to military hardware. This imbalance has sparked urgent discussions among global powers about securing alternative supply chains, especially as geopolitical tensions continue to escalate. The strategic importance of rare earths cannot be overstated, as they are indispensable in high-tech applications and the transition to green energy.

This report delves into a pivotal development in this landscape: a landmark agreement between the United States and Australia aimed at challenging China’s market stronghold. By examining the details of this partnership, its potential impacts, and the hurdles it faces, a clearer picture emerges of whether such collaborations can reshape the global rare earth sector. The stakes are high, as success could redefine resource security for allied nations.

Strategic Dimensions of the Bilateral Agreement

Core Components and Goals

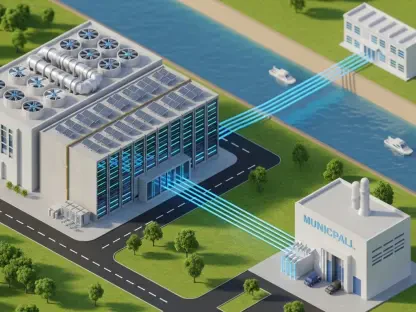

A significant pact between the US and Australia, announced by Australian Prime Minister Anthony Albanese and US President Donald Trump, marks a bold step toward diversifying rare earth supplies. This agreement commits $1 billion in joint investment over the next six months, fueling a project pipeline valued at $8.5 billion (A$13 billion). The focus is on expanding mining and processing capacities in both countries, with key initiatives like a gallium refinery in Western Australia backed by US funding.

Further bolstering this partnership, the US Export-Import Bank has pledged up to $2.2 billion in financing for critical minerals projects. The deal also includes collaborative efforts on pricing, permitting, and regulatory frameworks, alongside US ownership stakes in companies such as MP Materials and international partners. These measures aim to create a robust alternative to Chinese supply chains, addressing long-standing dependencies.

Market Reactions and Implications

The announcement triggered an immediate positive response in financial markets, with Australian rare earth companies seeing substantial gains. Arafura Rare Earths surged by 7.7%, Iluka Resources climbed over 3%, and Lynas Rare Earths also recorded notable increases. This market optimism reflects confidence in the potential of this pact to alter industry dynamics.

Beyond stock prices, existing ties, such as Lynas’s contract with the US Defense Department for a Texas facility, underscore the deepening collaboration. Looking ahead, this agreement could significantly reduce reliance on Chinese supplies by fostering a more diversified supply network, though its long-term impact hinges on effective project execution and sustained investment.

Obstacles to Disrupting China’s Hold

The challenge of breaking China’s dominance in the rare earth market is formidable, given its entrenched infrastructure and cost efficiencies. Decades of investment have allowed China to build a near-monopoly, making it difficult for other nations to compete on price or scale. This structural advantage poses a significant barrier for the US and Australia, even with their combined resources.

Scaling up operations in these countries also faces practical hurdles, including stringent environmental regulations and lengthy permitting processes. Community opposition to mining projects due to ecological concerns further complicates efforts. Overcoming these issues will require innovative approaches to sustainable practices and streamlined regulatory pathways.

Geopolitical risks add another layer of complexity, as China could retaliate with export restrictions or trade disputes in response to this pact. Such actions have disrupted supplies in the past, highlighting the need for strategic planning. Building resilience through broader allied partnerships and technological advancements in processing could help mitigate these risks over time.

Policy and Regulatory Support Structures

The US-Australia agreement is underpinned by a comprehensive regulatory framework designed to ensure smooth implementation. Joint oversight on pricing and permitting for projects and sales forms a critical component, aiming to create a transparent and efficient operational environment. This alignment seeks to prevent bottlenecks that could derail ambitious timelines.

Government backing through financing and policy coordination plays a vital role in accelerating critical minerals development. The integration of this pact with broader strategic initiatives, such as the AUKUS submarine deal reaffirmed by President Trump, signals a commitment to continuity in defense and resource security cooperation. This synergy strengthens the overall impact of the partnership.

Compliance with international trade regulations remains a key consideration for the pact’s success. Navigating these complex rules will be essential to avoid conflicts and ensure that investments translate into tangible outcomes. A balanced approach to policy enforcement could set a precedent for future collaborations in the critical minerals space.

Prospects for Global Supply Chain Evolution

The potential for this bilateral pact to diversify global rare earth supply chains offers a glimmer of hope amid current dependencies. By establishing alternative sources, the agreement could lessen the risks associated with over-reliance on a single supplier, fostering greater stability for industries dependent on these materials. This shift is particularly crucial for technology and defense sectors.

Emerging innovations in sustainable mining and processing present additional opportunities to enhance the pact’s impact. Advances in recycling rare earths from electronic waste and developing less invasive extraction methods could address environmental concerns while boosting supply. Such technological progress will be vital for long-term viability.

Consumer demand for tech products and defense capabilities continues to drive investment in this sector, creating a feedback loop of growth. However, external factors like global economic fluctuations or unexpected market disruptors could influence outcomes. Monitoring these variables will be essential to adapting strategies and maintaining momentum in reshaping supply networks.

Reflecting on a Strategic Leap Forward

Looking back, the US-Australia pact emerged as a defining moment in the quest for resource security, confronting China’s long-standing dominance in the rare earth market. The collaboration, marked by significant financial commitments and regulatory alignment, laid a foundation for reducing vulnerabilities in critical supply chains. It stood as a testament to the power of allied efforts in addressing global challenges.

The path ahead demands actionable steps, including sustained funding and innovation to overcome environmental and geopolitical obstacles. Strengthening partnerships beyond this bilateral agreement, by involving other like-minded nations, offers a promising avenue to build a more resilient industry framework. These efforts need to prioritize adaptability to ensure lasting impact.

Ultimately, the success of this initiative hinges on translating agreements into operational realities. Industry stakeholders and policymakers must focus on fostering technological breakthroughs and maintaining open channels of cooperation. By doing so, they can pave the way for a more balanced and secure rare earth market, safeguarding strategic interests for years to come.