In a landscape defined by political friction and protectionist threats, a different kind of alliance has quietly asserted its influence, revealing a powerful undercurrent of stability running beneath the turbulent surface of international diplomacy. This roundup explores the divergent paths of political rhetoric and institutional cooperation, drawing on insights from economic analysts and policy observers to understand how the world’s financial guardians are navigating an era of unprecedented geopolitical strain. We will delve into the expert consensus on the risks posed by aggressive trade tactics and the unified response from central bankers, offering a comprehensive view of this critical, yet often overlooked, dynamic.

The Unseen Economic Battleground

The paradox of the deteriorating U.S.-Canada political relationship under the Trump administration, set against a backdrop of deep institutional cooperation, has become a focal point for economic strategists. While headlines focused on escalating trade disputes, a less visible but equally significant story unfolded within the halls of the world’s central banks. This dynamic highlights a fundamental tension between transient political agendas and the enduring need for economic stability.

In an era of unpredictable, protectionist trade policies, the independence of central banks has emerged as a critical stabilizing force. Economic analysts widely agree that when political leaders wield tariffs and threats, the mandate of central bankers to maintain financial calm becomes paramount. This period has charted a course through rising economic tensions, but it is the surprising display of solidarity among financial leaders that truly defines this unique geopolitical moment.

A Tale of Two Relationships

Macklem’s Warning on Geopolitical Risk

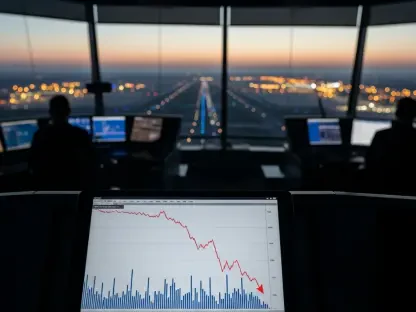

The Trump administration’s threats of severe tariffs marked a fundamental break from the established norms of “open rules-based trade.” Proposals for a 100% tariff on goods linked to Canadian deals with China and a 50% tariff on aircraft sent shockwaves through the integrated North American economy. This aggressive stance signaled a shift from negotiation to unilateral pressure, creating significant uncertainty for businesses on both sides of the border.

According to analysis from the Bank of Canada under Governor Tiff Macklem, this unpredictable approach was projected to have a “lasting negative impact” on both economies. The consensus among many economists was that such arbitrary measures injected destabilizing uncertainty into economic forecasts, making it difficult for businesses to plan and invest. The debate continues over whether these protectionist policies served their intended purpose or simply created geopolitical risks that complicated, rather than solved, economic challenges.

A Rally for Global Bankers

In a remarkable shift from the political fallout, the world’s central bankers presented a unified front in defense of U.S. Federal Reserve Chair Jerome Powell. This alliance became clear following a Department of Justice investigation into the Fed chair, an action widely seen as an attempt to exert political pressure. The response from the global financial community was swift and unambiguous.

This solidarity was most visibly illustrated through a joint statement expressing “full solidarity” with Powell, which underscored the shared risk perceived by global financial leaders. The prevailing view is that political pressure on any major central bank, particularly the U.S. Federal Reserve, threatens the stability of the entire international financial system. This collective defense was a powerful signal that the integrity of monetary policy institutions would be protected from political interference.

The Institutional Firewall

The emerging dynamic has led many observers to conclude that institutional relationships can act as a bulwark against disruptive political actions between allied nations. While governments engaged in public disputes, the operational ties between their central banks remained strong, providing a crucial layer of stability. This suggests a powerful, separate track of influence that operates independently of the daily political cycle.

This has raised the possibility of central bank networks serving as a vital backchannel for stability when diplomatic ties are strained. The quiet, consistent communication between financial leaders challenges the assumption that government-to-government relations dictate the entirety of a country’s international standing. Instead, these institutional firewalls prove that deep-seated cooperation can endure even amid sharp political disagreements.

A Contrast in Leadership

A stark juxtaposition emerged between the administration’s aggressive public posture and the discreet, supportive communication between central bank governors like Tiff Macklem and Jerome Powell. This contrast highlights the different tools available to political and institutional leaders. While politicians wielded tariffs and threats as instruments of policy, central bankers deployed joint statements and private assurances of integrity to calm markets and reinforce stability.

Financial analysts speculate on whether this quiet, institutional diplomacy offers a sustainable model for navigating future waves of economic nationalism. The effectiveness of this approach suggests that while political rhetoric commands attention, the methodical and collaborative work of central bankers may provide a more enduring foundation for global economic health. This model of leadership prioritizes long-term stability over short-term political wins.

Strategic Imperatives in an Unpredictable World

The core takeaway from this period is that political volatility does not negate the deep-seated need for institutional stability and cross-border financial cooperation. The events have provided a clear lesson for businesses and investors: monitoring the statements of central bankers offers a key indicator of underlying economic stability, separate from the noise of political rhetoric. These institutions often provide a more measured and forward-looking perspective on economic health.

Stakeholders can use the distinction between political posturing and institutional policy to better assess long-term geopolitical and economic risk. By understanding where the true centers of stability lie, they can make more informed decisions and navigate an increasingly complex global landscape. Recognizing that political relationships are only one part of the equation is now a strategic imperative for any international operator.

The Enduring Alliance in the Face of Division

The central theme that emerged was clear: while political relationships proved transient, the institutional pacts safeguarding the global economy were built to last. This episode reinforced the idea that the technocratic and collaborative nature of central banking provides a crucial counterbalance to the often-divisive world of politics. The future implications of this divide are significant, particularly in how central bank credibility will be tested in an increasingly polarized world.

Ultimately, this period demonstrated that the true strength of the global financial system lies not in the absence of political conflict, but in its ability to function despite it. The resilience shown by these institutions offered a powerful reminder that behind the daily headlines, a network dedicated to maintaining stability continues its vital work, ensuring that the foundations of the world economy remain secure even when the political ground shifts.