In a world where global trade is the lifeblood of economies, a new battleground has emerged at the docks, with massive container ships laden with goods worth billions being delayed or rerouted due to escalating port fees between the United States and China. These fees, imposed on vessels linked to each nation, are not mere administrative costs but strategic weapons in an intensifying trade war between the world’s two economic giants. This clash is already disrupting supply chains, inflating costs, and threatening the price of everyday items for consumers across the globe. What started as a policy skirmish is fast becoming a maritime standoff with far-reaching consequences.

The significance of this issue cannot be overstated. With over 90% of global trade moving by sea, the imposition of port fees is a direct hit to the arteries of commerce. These measures, initiated by the US to counter China’s dominance in maritime sectors and matched by China’s retaliatory levies, are more than financial penalties—they are symbols of a deeper economic rivalry. This story matters because it affects not just shipping magnates or policymakers, but also businesses and households reliant on affordable goods. The ripple effects could reshape trade patterns for years to come, making it critical to understand the stakes at play.

A New Front in the Trade War: Why Port Fees Matter Now

The maritime industry, once a neutral facilitator of global exchange, has been thrust into the spotlight as a key arena of conflict. Port fees, newly imposed by both the US and China on each other’s vessels, represent a calculated escalation in their ongoing trade war. Far from being a minor bureaucratic detail, these charges are poised to impact the cost of everything from electronics to energy, as shipping companies pass on the added expenses to consumers.

This development signals a shift in strategy, where control over shipping lanes becomes as contentious as tariffs on goods. Analysts estimate that container carriers alone could face costs of up to $3.2 billion by 2026 due to US fees, with China’s COSCO potentially bearing nearly half of that burden. Such figures highlight how a policy targeting ships can reverberate through entire economies, pushing stakeholders to rethink established trade routes.

The timing of these fees adds another layer of tension. With global supply chains already strained by geopolitical uncertainties, this maritime standoff risks further delays and disruptions. Companies are scrambling to adapt, but the broader question looms: can the system withstand this new pressure, or will it buckle under the weight of escalating costs?

The Backdrop of a Brewing Storm: US-China Trade Relations

To grasp the gravity of these port fees, a look at the larger landscape of US-China economic relations is essential. For years, the two nations have been locked in a struggle over trade imbalances, with tools like tariffs and export controls shaping their rivalry. The maritime sector, long seen as a neutral conduit, has now become a focal point as both sides seek leverage in this high-stakes game.

China’s dominance in shipbuilding and logistics has long been a sore point for the US, prompting policies aimed at leveling the playing field. In response, China has mirrored these actions with its own fees on US-linked vessels, creating a cycle of retaliation that shows no immediate sign of slowing. This tit-for-tat approach underscores a mutual unwillingness to concede ground, even at the risk of global trade disruptions.

Beyond economics, the conflict carries geopolitical weight. Issues like environmental shipping policies at the UN level have been dragged into the fray, with the US threatening sanctions against supporters of emission reduction plans backed by China. This intertwining of trade and broader strategic goals reveals how port fees are just one piece of a much larger, more complex puzzle.

Breaking Down the Port Fee Fallout: Impacts and Implications

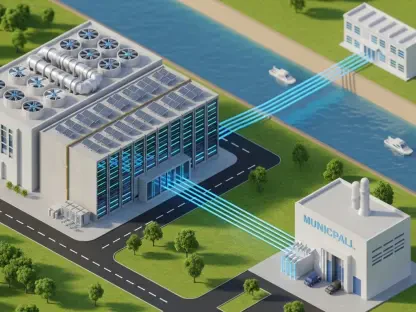

The financial sting of these port fees is immediate and severe for the shipping industry. The US initiated fees to challenge China’s maritime edge, while China countered with levies on US-operated ships, exempting its own fleet. This retaliatory framework has created a multi-billion-dollar burden, with projections showing significant losses for major players and a reshaping of trade dynamics.

Shipping companies are feeling the heat in tangible ways. Firms like Maersk and CMA CGM are rerouting vessels to avoid the costliest lanes, while 11-15% of global gas carriers and oil tankers face potential disruptions. Such adaptations, though necessary, lead to inefficiencies, with mid-voyage cargo diversions becoming a costly norm rather than an exception, ultimately impacting delivery timelines.

The fallout extends beyond logistics to global markets. Consumers may soon see higher prices as companies pass on these costs, while smaller businesses struggle to absorb the financial hit. Geopolitically, actions like China’s sanctions on subsidiaries of US-linked shipbuilders and looming US tariff threats of 100% on Chinese goods signal that port fees are fueling a broader confrontation, with no easy resolution in sight.

Voices from the Frontlines: Expert Insights and Industry Reactions

Those closest to the crisis offer a sobering view of its impact. Analysts at Clarksons Research have cautioned that freight patterns are being distorted by these fees, creating unpredictability in an industry that thrives on precision. Similarly, Xclusiv Shipbrokers points to the immense financial pressure on carriers, with some facing unsustainable losses if the situation persists.

Independent expert Ed Finley-Richardson paints a vivid picture of the chaos, describing shipowners engaged in “frantic improvisation” to dodge fees through last-minute route changes. Meanwhile, a Shanghai-based trade consultant provides a contrasting perspective, arguing that the industry’s resilience might prevent a complete collapse, though not without significant strain. These insights reveal a spectrum of concern and cautious optimism amid uncertainty.

Official voices add further depth to the narrative. China’s Ministry of Commerce has signaled a readiness for dialogue, even as it stands firm against perceived aggression. Such statements, combined with industry feedback, illustrate a landscape where frustration and hope coexist, with stakeholders anxiously awaiting the next move in this high-stakes chess game.

Navigating the Storm: Strategies for Mitigation and Dialogue

Amid the turbulence, actionable strategies are emerging to help stakeholders weather this crisis. Shipping companies are exploring practical solutions, such as adjusting fleets or leveraging exemptions for empty vessels and specific charters to minimize exposure to fees. These adaptations, while not perfect, offer a buffer against mounting costs.

On the policy front, engagement is critical. Trade groups and businesses are urged to push for clearer exemptions and advocate for negotiations, capitalizing on both nations’ expressed willingness to discuss solutions. Such efforts could help de-escalate tensions before they spiral further, preserving at least some stability in global trade flows.

Looking ahead, broader cooperation on interconnected issues, like environmental shipping standards, could serve as a bridge to dialogue. Monitoring tools and market forecasts also remain vital for traders to anticipate disruptions. These combined approaches provide a roadmap for navigating the choppy waters of this US-China maritime conflict, offering hope for a balanced resolution if pursued with urgency and commitment.

In reflecting on this chapter of trade tensions, it is clear that the clash over port fees has left an indelible mark on global commerce. The financial burdens and logistical upheavals have tested the resilience of industries and nations alike. Yet, as the dust settles, the path forward demands proactive steps—stakeholders need to prioritize sustained dialogue, advocate for fair exemptions, and invest in adaptive strategies to prevent further economic fallout. The lessons learned underscore the importance of collaboration over confrontation, urging all parties to chart a course toward stability in an interconnected world.