As we approach 2025, the economic outlook appears promising, with an environment characterized by low unemployment rates, controlled inflation, and rising corporate profits. This favorable combination presents an excellent opportunity to focus on achieving personal financial stability and growth. Setting strategic financial goals and leveraging new regulations can pave the way to a more secure financial future. Adopting proactive measures now could help reap significant benefits in the long run by addressing potential risks and capitalizing on market opportunities. Here, we explore several key strategies that can guide you in navigating the financial landscape of 2025 to ensure a strong economic foundation for the years ahead.

Setting Clear Financial Objectives

Achieving financial stability begins with setting clear and attainable financial objectives. In 2025, prioritizing specific savings targets is crucial, whether it’s building an emergency fund, saving for significant purchases, or planning for retirement. High-yield savings accounts and certificates of deposit (CDs) are excellent options, offering competitive interest rates and low risk. By setting tangible goals and regularly tracking progress, individuals can stay motivated and make informed decisions that align with their financial aspirations. Additionally, creating a monthly budget to monitor income and expenses ensures that you stay on track, enabling better control over your financial future.

Developing a solid financial plan also involves being prepared for unexpected expenses and emergencies. Establishing an emergency fund with three to six months’ worth of living expenses can provide a safety net during unforeseen circumstances, such as job loss or medical emergencies. Automating savings can simplify this process, ensuring that a portion of your income is consistently directed towards your emergency fund. Moreover, reassessing your financial goals periodically allows you to adapt to any changes in your personal or economic situation, ensuring that your financial plan remains relevant and effective.

Leveraging New Financial Regulations

The financial landscape’s regulatory framework has seen several positive changes, benefiting consumers and addressing common banking challenges. A significant update in 2025 is the reduction of overdraft fees by the Consumer Financial Protection Bureau, which has brought charges down from approximately $35 to just $5. This change offers substantial savings and increased flexibility in managing personal finances. Taking advantage of these new regulations involves reassessing your current banking arrangements and considering options that align better with these favorable conditions. Switching to banks with lower fees, higher interest rates on deposits, and improved customer services can further enhance your financial stability.

Another aspect to consider is the growing availability and popularity of online and mobile banking services. These digital platforms often offer better savings rates, lower fees, and more convenient access to financial management tools. Utilizing these services can streamline your financial management process, ensuring efficient tracking of expenses, quick transfers, and ease of monitoring your overall financial health. Additionally, staying informed about ongoing regulatory changes and adopting practices that capitalize on these updates can help maintain and enhance your financial resilience.

Early Tax Season Preparation

Proactively preparing for tax season is a crucial strategy that can alleviate stress and optimize your financial outcomes. The IRS recommends organizing tax documents early to ensure timely and accurate submissions. This preparation includes gathering all necessary paperwork, such as W-2 forms, 1099 forms, and any receipts for deductible expenses. By doing so, individuals can avoid the last-minute rush, reduce errors in their filings, and potentially maximize their tax refunds. Furthermore, utilizing free e-filing services available in several states can expedite the submission process and provide an added layer of convenience.

In addition to early preparation, exploring available tax deductions and credits can significantly impact your financial standing. Familiarize yourself with tax benefits that you may qualify for, such as deductions for mortgage interest, student loan interest, or contributions to retirement accounts. Consulting a tax professional can also provide valuable insights tailored to your specific financial situation, ensuring that you take full advantage of the tax benefits available to you. Planning your taxes well in advance and remaining aware of any changes in tax laws can help you make informed decisions, ultimately contributing to a more secure financial future.

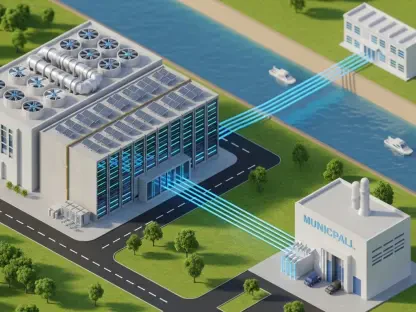

Monitoring Corporate Earnings and Investment Trends

Staying informed about corporate earnings and investment trends is essential for identifying potential opportunities in the stock market, especially within the tech sector. As robust growth continues, monitoring these trends can provide valuable insights into emerging industries and profitable ventures. Keeping an eye on quarterly earnings reports and analyzing market performance can help investors make informed decisions, potentially leading to substantial returns. Diversifying your investment portfolio by including a mix of stocks, bonds, and other assets can also mitigate risk while maximizing growth potential.

In addition to monitoring earnings, staying updated on industry news and developments is crucial. Technological advancements, regulatory changes, and market shifts can all influence investment opportunities. Engaging with financial news sources and participating in investment forums can offer different perspectives and expert opinions, aiding in comprehensive analysis. By remaining vigilant and adaptable, you can position yourself to seize opportunities as they arise, contributing to your long-term financial security.

Reviewing and Adjusting Spending Habits

As we move toward 2025, the economic outlook is looking quite promising. We’re seeing an environment marked by low unemployment rates, controlled inflation, and increasing corporate profits. This ideal mix creates a fantastic opportunity for individuals to focus on their personal financial stability and growth. By setting strategic financial goals and taking advantage of new regulations, one can pave the way for a more secure financial future. Taking proactive measures now can yield significant long-term benefits, helping to manage potential risks and capitalize on market opportunities. In this context, we delve into several key strategies that can assist you in navigating the financial landscape of 2025. These strategies are designed to help you build a strong economic foundation for the years ahead, ensuring you are well-prepared to face any challenges and seize any opportunities. Whether you’re looking to invest wisely, improve your savings, or plan for retirement, these steps can guide you toward financial success and stability in the coming years.