As the leader of Government Curated, Donald Gainsborough operates at the very center of policy and legislation. With a sharp understanding of the forces shaping Washington, he provides a critical perspective on the increasing friction between political agendas and the data-driven world of economic policy, particularly concerning the Federal Reserve’s embattled independence.

A senior official recently called a Fed research paper “an embarrassment” and suggested its authors be disciplined. What are the potential consequences when political officials publicly call for punishing central bank researchers?

The immediate consequence is a chilling effect on intellectual freedom, which is the bedrock of sound policymaking. When a senior official suggests researchers should be “disciplined” for their findings, it sends a clear message: produce politically convenient results or face professional consequences. This erodes the very foundation of data-driven analysis the Fed relies on. Over time, you risk creating a culture of self-censorship where economists might shy away from sensitive but crucial topics, ultimately degrading the quality of information that leaders like Chair Jerome Powell use to make decisions impacting the entire economy.

A Minneapolis Fed president noted that the central bank’s 12 regional branches have their own research departments and that their findings don’t always align. How does this decentralized structure and breadth of opinions contribute to better policy?

That decentralized structure is one of the Fed’s greatest strengths. It’s an internal system of checks and balances. Having 12 different research departments means you don’t have a single monolithic view coming out of Washington. As the Minneapolis Fed president said, this is how they get better and learn. One branch might see an emerging trend in their region that others miss. This “breadth of opinions” creates a competitive, peer-reviewed environment internally, ensuring that by the time a policy is debated, it has been stress-tested from multiple angles, leading to more robust and well-considered outcomes.

The White House argued that certain research was flawed and designed for news headlines, not peer review. Considering that other institutions like Harvard and the CBO produced similar findings, what does this specific incident reveal about the tension between academic standards and political pressure?

It reveals that the criticism was less about academic rigor and more about political inconvenience. When institutions like Harvard Business School, Yale, and the Congressional Budget Office are all reaching similar conclusions, the argument that one Fed paper “fell short” of academic standards doesn’t hold much water. This incident highlights a classic political tactic: when you can’t refute the data, you attack the credibility of the source. It underscores a fundamental tension where politics demands favorable narratives, while true academic inquiry is obligated to follow the data, wherever it may lead.

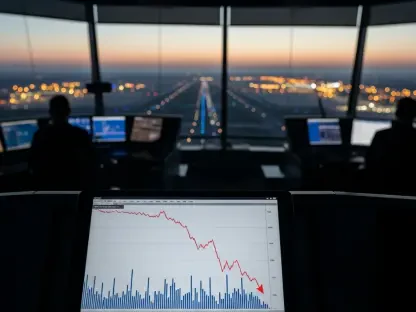

One official cited a $1,400 rise in average inflation-adjusted wages as proof that tariffs made consumers better off. How does that specific claim contrast with broader economic analyses of tariffs?

That claim is a perfect example of cherry-picking a single data point to build a narrative. While it’s true that inflation-adjusted wages may have risen by that amount, that figure exists in a much larger, more complex economic picture. The official conveniently ignores that import prices, after an initial drop, leveled off, and that numerous studies—including the one he criticized—show that tariffs often lead to higher consumer prices. To get a true assessment, you must weigh that $1,400 wage gain against the increased costs that families are paying for goods, a nuance that broader analyses from the Fed and others consistently highlight.

There have been reports of attempts to compromise the Fed’s independence, including subpoenas from the Justice Department. From an institutional standpoint, what are the primary mechanisms the Fed uses to safeguard its data-driven analysis from political influence?

The Fed’s primary defense is its institutional structure and a deep-seated cultural commitment to its mandate. First, you have leaders like Chair Powell who are willing to take the unprecedented step of publicly pushing back, as he did against the Justice Department’s subpoenas, framing them as an attempt to apply political pressure. Second, as we discussed, the decentralized nature of the 12 regional banks diffuses pressure and fosters independent thought. Ultimately, the Fed’s strongest shield is its unwavering public commitment to making decisions “based on data and analysis,” a principle that officials like Kashkari continually reinforce.

What is your forecast for the state of Federal Reserve independence over the next few years?

My forecast is that the Fed’s independence will face its most significant stress test in a generation. The attempts to influence its decisions and discredit its research are likely to become more frequent and more overt. However, the institution itself is resilient. Its leaders have shown a willingness to publicly defend their nonpartisan mandate. The coming years will be a battle of institutional integrity against political expediency, and the outcome will depend heavily on the Fed’s ability to continue demonstrating that its decisions are driven by data, not by politics.