The silent, intricate dance of global diplomacy is now being choreographed on the factory floors of semiconductor manufacturers, where microscopic circuits carry the weight of national security. The recent standoff between the Netherlands and China over the Dutch chipmaker Nexperia serves as a stark illustration of this new reality, transforming a once obscure corporate dispute into a flashpoint in the escalating global technology war. This conflict highlights a world where the flow of microchips is as strategically vital as the flow of oil, and national interests are increasingly colliding with the complex, interwoven fabric of the globalized economy.

The Global Semiconductor Battlefield More Than Just Silicon

The semiconductor industry has become the central nervous system of the modern world, powering everything from consumer electronics and vehicles to advanced military hardware. This critical importance has created a distinct geopolitical landscape. The ecosystem is dominated by a few key players: the United States leads in chip design and innovation, Taiwan and South Korea excel in high-volume fabrication, and the Netherlands, home to firms like ASML, provides the indispensable manufacturing equipment.

Within this framework, Nexperia occupies a uniquely sensitive position. As a Dutch company with deep roots in European industry, it is considered a strategic asset. However, its ownership by the Chinese technology conglomerate Wingtech places it squarely at the intersection of competing geopolitical ambitions. This ownership structure has become a lightning rod in an era of rising “techno-nationalism,” a trend where nations prioritize control over critical technologies, often at the expense of free-market principles and international commerce.

A Shifting Landscape Trends and Economic Shockwaves

From Global Supply Chains to Geopolitical Weapons

The very concept of the global supply chain, once celebrated for its efficiency, is being fundamentally redefined. Critical technologies, particularly semiconductors, are no longer just commercial products; they are potent tools for exerting international leverage. National security doctrines are rapidly evolving to encompass economic and technological sovereignty, viewing domestic control over key industries as essential for national defense.

This new paradigm creates an inherent conflict between the decades-old model of globalized manufacturing and the urgent push for national self-reliance. China’s ambitious strategy to achieve semiconductor independence is a primary driver of this trend, forcing other nations to re-evaluate their own vulnerabilities. Beijing’s efforts to build a complete domestic chip ecosystem are sending ripples across the globe, compelling Western governments to safeguard their own technological crown jewels from foreign acquisition or influence.

Measuring the Fallout Economic Tremors and Market Volatility

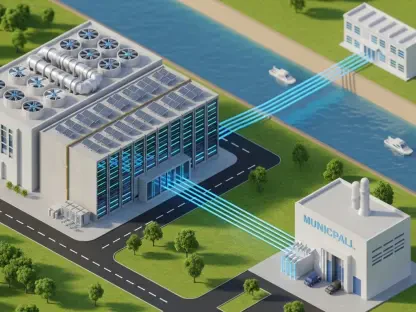

The abstract geopolitical chess game has had tangible consequences. When China retaliated against Dutch actions by blocking exports of chips packaged at Nexperia’s Chinese facilities, the economic tremors were felt as far away as Japan. Automakers Honda and Nissan were forced to scale back production, demonstrating the fragility of just-in-time supply chains and the profound vulnerability of industries dependent on a steady flow of semiconductors.

These targeted export controls and administrative hurdles create significant market disruptions, injecting a new layer of volatility into an already strained industry. Projecting the full economic cost of a widespread decoupling of technology supply chains is difficult, but the Nexperia case provides a worrying preview. The incident underscores how quickly a diplomatic dispute can translate into production stoppages, lost revenue, and heightened uncertainty for businesses worldwide.

Navigating the Nexperia Nexus A Tangle of Ownership and Influence

The Nexperia saga perfectly encapsulates the challenge governments face in regulating domestically critical companies that are under foreign ownership. The Dutch government found itself caught in a complex web, attempting to secure its national interests while navigating the demands of Nexperia’s Chinese parent company, Wingtech, and responding to significant political pressure from allies like the United States.

The situation was further complicated by internal corporate governance issues, which culminated in a Dutch court’s removal of Nexperia’s Chinese CEO over alleged mismanagement. This action, while separate from the government’s intervention, became intertwined with the larger geopolitical narrative, blurring the lines between corporate oversight and state action. For the Netherlands, it became a high-stakes balancing act: maintaining its reputation for economic openness while simultaneously protecting its critical infrastructure and technological base from perceived threats.

The Long Arm of the Law Governments Wielding Regulatory Power

In a decisive move, the Dutch government issued a formal order to prevent Wingtech from making unapproved operational changes at Nexperia, effectively asserting state control over a private company’s strategic direction. The stated goal was to secure domestic chip supplies and prevent the transfer of valuable production capabilities out of Europe. China’s Ministry of Commerce responded swiftly, condemning the move as “improper administrative interference” and demanding that the Netherlands “correct its mistake.”

The geopolitical pressure was not one-sided. The Dutch action followed explicit warnings from the United States that Nexperia could face sanctions if its Chinese leadership remained in place. Though the Dutch government denies acting solely at Washington’s behest, the timing was notable. A delicate, temporary truce was eventually reached, with the Netherlands suspending its order and China granting exemptions for civilian-use chips from its export ban, but the underlying tensions remain unresolved.

The Chip War’s Next Chapter De-risking and the New World Order

The Nexperia case is more than a one-off dispute; it serves as a potential blueprint for future conflicts over strategic technology assets. It has accelerated the push in Europe and the United States for supply chain diversification and “de-risking”—a strategy aimed at reducing dependency on any single country, particularly China, for critical components. This trend is fundamentally reshaping global investment and trade flows.

Consequently, the future of cross-border mergers and acquisitions in sensitive industries like semiconductors is now fraught with uncertainty. Governments are likely to apply far greater scrutiny to such deals, prioritizing national security over purely economic considerations. As more nations embrace technological self-reliance, the potential for escalating trade disputes, export controls, and investment blockades grows, heralding a new, more fragmented world order for the technology sector.

Final Verdict The High Price of Technological Sovereignty

The clash over Nexperia revealed the steep price of prioritizing technological sovereignty in an interconnected world. It laid bare the fundamental conflict between the imperatives of national security and the established principles of the globalized economic order. The dispute left a lasting mark on Netherlands-China relations and sent a clear signal across the global semiconductor industry that geopolitical alignment is now a critical factor in business operations.

For businesses and policymakers, the key takeaway was the urgent need to navigate a new landscape where supply chains are weaponized and corporate ownership is a matter of state interest. The events demonstrated that while a fragile truce can be achieved, the core friction between national ambition and global integration persists. The central question that emerged was not whether cooperation or conflict would define the future of technology, but rather how to manage the inevitable tension between the two.