As the deadline for crafting a government funding bill approaches, House conservatives are advocating for the inclusion of significant cuts made by the Department of Government Efficiency (DOGE) into the bill. This push has complicated legislative negotiations and raised concerns about a potential

The ongoing evolution of the cryptocurrency industry is at the forefront of political discourse in the United States. Key among the legislative efforts in this sector is the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. This article delves into the intricate

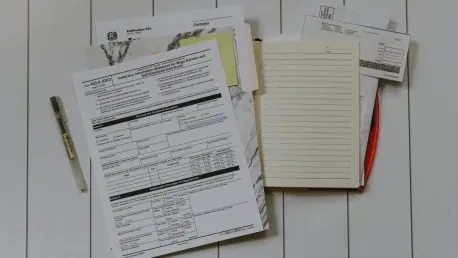

The possibility of losing the 20% Qualified Business Income (QBI) deduction by the end of 2025 poses a significant challenge for American businesses, particularly pass-through entities, which employ more than half of private-sector workers. Enacted as part of the 2017 Tax Cuts and Jobs Act (TCJA),

Washington, D.C. Mayor Muriel Bowser recently voiced her strong objections to a House Republican stopgap funding plan that could potentially result in a significant financial shortfall for the nation's capital. Bowser's concerns center around the GOP's continuing resolution (CR), aimed at keeping

International travelers in 2025 will consistently face a range of new laws and regulations that will significantly impact their finances, adding layers of complexity to their trips. National and regional legislation targeting currency control, tourist taxes, and digital payment systems will impose

Federal spending plays a critical role in shaping the daily lives of American citizens and the nation's future. Its complexity and far-reaching effects influence essential services, infrastructure, and national priorities, making it a vital aspect of government operations. By understanding how