A political savant and leader in policy and legislation, Donald Gainsborough is at the helm of Government Curated, where he deciphers the intricate power plays shaping Washington. With the Treasury Department spearheading an unprecedented effort to centralize control over financial regulation, Gainsborough offers a sharp analysis of this “fundamental reset.” His insights cut through the noise, revealing the administration’s strategic overhaul of the post-crisis rulebook and the high-stakes trade-offs between unleashing economic growth and preventing the next market meltdown. We delve into the mechanics of this coordinated push, exploring how the administration is redefining the roles of the Federal Reserve, FDIC, and OCC to align them with a singular economic vision, the specific rules being dismantled, and the potential long-term consequences for Wall Street and the American economy.

You’ve called for a “fundamental reset” of financial regulation. How does centralizing control over traditionally independent agencies achieve this, and what are the specific, step-by-step actions you are taking to align regulators from the Fed, FDIC, and OCC toward this common vision?

The idea of a “fundamental reset” is about moving away from what we see as a purely technocratic, and frankly, stifling approach to regulation. For too long, agencies have operated in silos, focused on prophylactic rules without a cohesive, long-term vision for the whole financial system. Centralizing this vision within Treasury ensures we’re all looking to the same “true north,” which is economic growth. The process is hands-on; Secretary Bessent and his deputies are in regular meetings with the heads of the Fed, FDIC, and OCC, actively pushing his priorities. It’s a deliberate strategy to ensure alignment. The regulators selected for these roles, like Jonathan Gould at the OCC and Michelle Bowman at the Fed, were chosen because they already “sing from the same songbook” and have a track record of supporting a more streamlined approach. This creates a powerful, unified front to revisit the entire post-crisis framework, from capital requirements to anti-money laundering rules.

Concerns have been raised that rapid deregulation could prioritize Wall Street’s interests over the stability of the financial system. How do you balance the goal of boosting economic growth with the need to prevent another market meltdown, and what specific safeguards are you implementing?

That’s a narrative we hear often, but it misinterprets the goal. The post-crisis framework wasn’t just about safety; it became a system that entrenched the biggest banks, suffocated community lenders, and stifled innovation. The real winners were the Washington bureaucrats. Our approach is to recalibrate, not to recklessly dismantle. The safeguard is a smarter, more balanced regulatory structure. We’re not just throwing out rules; we’re revisiting the very specific calibration of granular requirements to ensure an appropriate balance. The Financial Stability Oversight Council, for example, is being refocused. Instead of being solely a “prophylactic” body, as it was described in the past, its mandate now explicitly includes emphasizing economic growth. It’s about creating a system where banks can innovate and lend, fueling the economy, without reintroducing the systemic fragilities of the past.

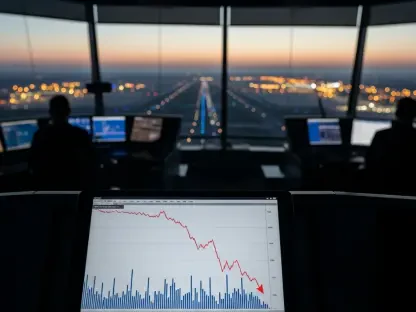

One analysis suggests deregulation has already freed up significant lending capacity. Could you walk us through the specific rule changes that contributed to this outcome and share some real-world examples of how this capital is being deployed to help businesses and consumers?

Absolutely. The Secretary himself cited a private-sector analysis showing that our deregulatory efforts have already unlocked what amounts to $2.5 trillion in extra lending capacity. This isn’t just a theoretical number; it’s a direct result of re-evaluating burdensome rules that were holding capital hostage on bank balance sheets. We’re targeting the core of the post-crisis regime, particularly the rules that increased banks’ reliance on debt and the high compliance costs associated with them. By easing some of these sweeping controls, we’ve reduced the cost for megabanks to trade in U.S. government debt and made it easier for lenders of all sizes to deploy capital. This capital is now flowing into the economy, supporting businesses looking to expand, families buying homes, and innovators developing new technologies.

The administration appears focused on removing barriers for banks using AI and integrating digital assets. What is the economic vision behind these moves, and what specific protocols are being developed to manage the new types of risks these technologies could introduce to the banking system?

The economic vision is one of innovation and competitiveness. We cannot allow our financial system to be anchored in the past while the rest of the world moves forward. AI and digital assets represent a massive opportunity for efficiency, better services for consumers, and new avenues for growth. The administration’s plan is rooted in a blueprint for innovation that also accounts for safety and soundness. So, as we look to remove regulatory barriers, we are simultaneously working with the agencies to develop a framework that understands these new technologies. It’s not about letting them run wild. It’s about creating clear rules of the road that allow banks to adopt these tools responsibly, managing the unique risks they present while harnessing their potential to strengthen our economy.

Critics argue that pressuring agencies to promote borrowing for things like housing or AI might create more leverage without solving underlying economic issues. How would you describe the difference between sound, growth-oriented policy and simply encouraging more debt, and where do you draw that line?

That criticism paints a distorted picture. The concern that we’re just piling on leverage to solve deeper economic problems misses the point entirely. Sound, growth-oriented policy is about enabling the productive use of capital. It’s about ensuring that a small business can get a loan to hire more workers, or that a tech startup can get the financing to develop a breakthrough in AI. Simply encouraging debt for its own sake, without an underlying productive purpose, is a recipe for instability. The line is drawn at the purpose and prudence of the lending. Our reforms are designed to make the system more efficient so that capital can flow to these productive ends. It’s not about pushing “cheaper credit as a tool to address housing affordability” in a vacuum; it’s about ensuring the entire regulatory framework supports a dynamic, growing economy, rather than suffocating it.

Some observers, even those who disagree with your policy goals, are sympathetic to a more hands-on Treasury approach to avoid regulatory gridlock. Can you share an anecdote where a lack of central coordination previously stalled a key rule, and how your current approach solves that problem?

It’s a very valid point, and we saw a perfect example of this kind of gridlock in the previous administration. The Biden-era regulators had a shared goal of revising rules to make sure banks were prepared for unexpected losses—a crucial piece of the puzzle. But the attempt completely fell apart. Fierce pushback, particularly from the banking industry, caused major delays. When the Fed’s Vice Chair for Supervision tried to readjust the plan, it was effectively sunk because the director of the Consumer Financial Protection Bureau objected to the process. There was no central coordinating force to get everyone in the room and hash out a solution. That’s precisely the problem our hands-on approach solves. By having Treasury actively steer the conversation and define that “true north,” we prevent agencies from working at cross-purposes and ensure that important reforms don’t die on the vine due to procedural squabbles.

What is your forecast for the future of U.S. financial regulation?

My forecast is for a continued and deliberate recalibration of the entire post-crisis regulatory framework. This is not a series of one-off, reactionary measures. What you’re seeing is the execution of a long-term plan rooted in a blueprint for innovation and economic growth. We will continue to revisit the most granular requirements, from banks’ access to cash to their financial buffers against losses, to ensure they strike the right balance. The era of a hands-off Treasury that defers completely to the independent agencies is over. The future is a more centralized, coordinated system where financial regulation is viewed as a dynamic tool to actively promote a healthy, competitive, and stable U.S. economy, not just as a static set of constraints.