Political savant and leader in policy and legislation, Donald Gainsborough, helms Government Curated. With his deep understanding of intricate legislative measures and policy impacts, he sheds light on Thailand’s recently instituted emergency decree aimed at curbing tech-driven frauds.

Can you explain the rationale behind Thailand’s new emergency decree targeting scams?

The primary aim of the decree is to combat the rising incidences of technology-driven frauds that prey on unsuspecting citizens via digital and phone channels. By mandating rigorous scrutiny and accountability from banks, telecom operators, and social media platforms, the government seeks to create a more secure environment for its people.

Why did the government choose to enact this decree in April 2025?

The enactment in April 2025 aligns with the increasing urgency to protect citizens as digital transactions and communications become more prevalent. The government likely saw a critical need to step up regulatory measures to preempt and thwart scam operations that have been escalating in complexity and frequency.

Could you elaborate on the specific measures banks are required to take under this new law?

Banks are required to disclose detailed information about accounts and transactions flagged for suspicious activities. This means they must promptly identify and report any potentially fraudulent operations, leading to immediate freezes on these questionable transactions.

What types of details must banks disclose about flagged accounts and transactions?

Banks need to reveal pertinent details like the account number, transaction history, and any unusual patterns that might suggest fraudulent behavior. This transparency is crucial for prompt action to be taken against potential threats.

How are suspicious operations identified and assessed?

Suspicious operations are often flagged through advanced analytics and monitoring systems that identify anomalies or irregular transaction patterns. These could include large withdrawals, frequent transfers to unknown accounts, or transactions that diverge significantly from the account’s typical activity.

How are telecom providers expected to filter out dubious SMS messages under the decree?

Telecom providers are expected to implement robust filtering mechanisms that can detect and block suspicious SMS messages. This might involve using algorithms that flag keywords or patterns commonly associated with scam messages.

What criteria are used to determine which messages are considered “dubious”?

“Dubious” messages typically include those containing links, promotional offers, or solicitations that are unverified or have been previously linked to fraudulent activities. The criteria might also encompass the frequency and bulk of the messages being sent.

What responsibilities does the National Broadcasting and Telecommunications Commission have under the new decree?

The National Broadcasting and Telecommunications Commission is responsible for enforcing and monitoring compliance with these new regulations. They play a pivotal role in halting services linked to scam activities and ensuring that telecom operators and other stakeholders adhere to the new guidelines.

How will this commission halt scam-linked services?

The commission can order immediate termination of services associated with scams, levy fines, or even revoke licenses of entities that fail to comply. By doing so, they aim to disrupt the operations of scammers and protect consumers from falling victim to fraud.

What penalties do companies and individuals face if they fail to comply with the decree?

Companies could face fines up to THB500,000, and individuals might face a year in prison, fines up to THB100,000, or both. These penalties underscore the seriousness with which the government views non-compliance and its commitment to maintaining a secure digital environment.

Are there specific circumstances under which companies might face the maximum fine of THB500,000?

The maximum fine is generally reserved for severe instances of non-compliance where there is evident negligence or deliberate attempts to subvert the law. Repeated offenses or cases where large numbers of consumers are affected might also attract the highest penalties.

Under what conditions might individuals see up to a year in prison?

Individuals could face imprisonment under conditions where their actions directly facilitate or exacerbate fraudulent activities. This includes willful negligence or active participation in scam operations, leading to substantial harm to victims.

How does the law address the issue of unregistered mobile subscribers?

The law mandates stringent verification processes to ensure all mobile subscribers are registered accurately. Providers must verify the identities of their subscribers and maintain updated records, reducing the risk of anonymous or fraudulent accounts.

What penalties are in place for the misuse of deceased individuals’ data?

Using deceased individuals’ data for scams is a grave offense. Penalties include hefty fines and imprisonment, reflecting the government’s stance on the sanctity and protection of personal data.

How do these measures compare to those implemented in other countries, such as Singapore?

Thailand’s measures mirror the shared responsibility frameworks seen in countries like Singapore, where various stakeholders are held accountable for combating fraud. Both countries recognize the need for multi-layered approaches to protect their digital ecosystems.

Can you provide examples of similar frameworks from other countries?

Aside from Singapore, countries like the United States and the United Kingdom have implemented comprehensive regulations requiring financial institutions, telecom providers, and social media platforms to collaborate closely in identifying and mitigating scams, showcasing a trend towards collective security.

Thailand has tightened regulations for digital asset exchanges as well. Can you describe these new requirements?

Under the new regulations, digital asset exchanges must adhere to stringent security measures and transparency in their operations. Foreign platforms are required to secure local licenses, ensuring they meet the legal and safety standards set by Thai authorities.

Why is it necessary for foreign platforms to secure licenses to operate locally?

Licensing ensures that foreign platforms are subject to Thai laws and regulations, creating a level playing field and protecting local consumers from potential risks associated with unregulated entities.

How do you foresee the impact of these new regulations on the fight against cybercrime in Thailand?

These regulations will likely have a profound impact by creating a more secure and trustworthy environment. They will deter potential scammers due to the high risks of detection and severe penalties while encouraging consumer confidence in digital transactions and communications.

What are the anticipated benefits for consumers?

Consumers can expect heightened security for their personal and financial information. The stringent measures will help reduce instances of fraud, providing peace of mind and reinforcing trust in the digital economy.

Are there any potential drawbacks or challenges that industries might face?

Industries might face challenges in adapting to the new regulations quickly, including the costs of implementing advanced monitoring and reporting systems. Additionally, there could be initial resistance or hesitance from stakeholders who must navigate the new compliance landscape.

Can you discuss how the concept of shared responsibility plays a role in these new regulations?

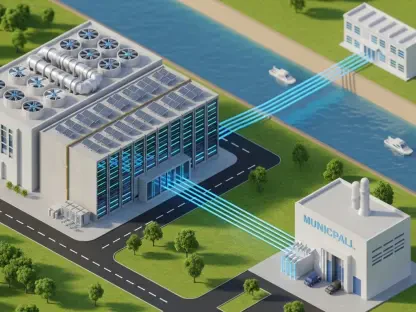

Shared responsibility is central to these regulations, meaning that various stakeholders—from financial institutions to telecom operators—must work together. This collective effort is crucial for creating a comprehensive and effective defense against fraud.

How does this decree align with global trends in combating technology-driven fraud?

The decree aligns with global trends by emphasizing stringent regulatory requirements and shared accountability among stakeholders. It reflects a broader movement towards international cooperation and robust legal frameworks to counter tech-driven fraud effectively.

What is your forecast for the future of cybercrime management in Thailand?

Thailand is on a promising path towards more secure digital environments. Continued innovation in policies and constant vigilance by all stakeholders will be key. As cybercrime evolves, so must the strategies to combat it, ensuring they stay a step ahead of the fraudsters.