A political savant and leader in policy and legislation, Donald Gainsborough is at the helm of Government Curated. With Canada unveiling a monumental shift in its defense and industrial strategy, his insights are crucial for understanding the tectonic changes ahead. This interview explores the ambitious plan to double defense spending, champion a “Buy Canadian” procurement model, and redefine the nation’s role on the world stage, moving from a self-described laggard to a proactive security partner.

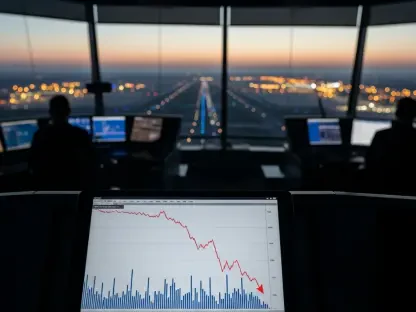

For decades, Canada has been described as a defense-spending laggard. What specific vulnerabilities has this created, and how will doubling defense expenditures over the next decade specifically address the new security challenges emerging in the Canadian Arctic?

It’s a frank and necessary admission. The truth is, for a long time, we’ve been insulated by our geography and sheltered by our alliances, particularly with the United States. This created a dangerous complacency, a vulnerability born from underinvestment in both our military and our domestic industrial base. We simply haven’t spent enough. Now, with the Arctic becoming a contested space and the nature of warfare itself changing, that’s a vulnerability we can no longer afford. Doubling our defense expenditures isn’t just a line item; it’s a fundamental course correction. This strategy is about protecting Canada’s sovereignty in its fullest sense, and that is especially critical up North where new threats from drones and autonomous systems are proliferating.

The new strategy’s “guiding North Star” is to “Buy Canadian.” Could you walk us through the selection process for the “defense champions” due this summer, and what metrics will ensure this initiative boosts small business revenue by over C$5.1 billion annually?

“Buy Canadian” is more than a slogan; it’s the core of this entire industrial strategy. The government is creating a symbiotic relationship with industry by selecting a list of “defense champions” this summer. These will be our key strategic partners, the anchors of our new defense ecosystem. The selection will likely focus on companies that align with the ten sovereign capabilities identified in the plan, from AI to aerospace. The real genius, though, is how this top-tier selection is designed to cascade down. The C$5.1 billion annual revenue boost for small and medium-sized businesses isn’t a separate goal; it’s a direct consequence. These champions will be expected to build and nurture domestic supply chains, ensuring that this massive government investment circulates within our own economy and builds capacity from the ground up.

The plan sets ambitious goals, such as increasing Canadian defense-industry revenues by over 240% by 2035. What are the key steps to achieve this massive industrial scale-up, and what trade-offs might exist between prioritizing domestic firms and acquiring the best available global technology?

The scale of this ambition is staggering—a projected half a trillion dollars in overall investment by 2035. The primary lever to achieve that 240% revenue growth is the commitment to award 70% of defense acquisitions to Canadian firms. This, combined with an 85% increase in R&D spending, creates an unprecedented demand signal for our domestic industry. However, you’re right to point out the inherent trade-off. A rigid “Buy Canadian” policy can sometimes mean not buying the absolute best or most cost-effective platform available on the global market. The challenge will be striking a balance: building our sovereign capabilities without isolating ourselves from the cutting-edge technology developed by our allies. It’s about being a smart customer, not just a patriotic one.

Ten “sovereign capabilities” are listed, including AI, quantum computing, and missile production. How were these specific areas prioritized over others, and what immediate investments are planned to ensure Canada becomes a leader in these fields rather than just a participant?

Those ten capabilities weren’t chosen at random. They represent a clear-eyed assessment of two things: where the future of conflict is headed, and where Canada has a credible chance to build a real strategic advantage. We’re seeing a global proliferation of drones and autonomous systems, so investing in AI, quantum, and uncrewed vessels is about skating to where the puck is going. The inclusion of things like missile production reflects a hard lesson learned from recent global conflicts about the fragility of supply chains for essential munitions. The investment to become a leader is baked into the strategy, with the government planning to boost its defense-related R&D investment by 85%. This isn’t just about buying things; it’s about inventing them here at home.

With the pledge to finally meet the 2% NATO spending commitment and aim for 5% by 2035, how does this shift Canada’s role within the alliance? Beyond funding, what practical effects will this have on reducing dependency on the U.S. for key defense products and services?

This is transformative. For the first time, Canada will meet its 2% NATO commitment, and the pledge to reach 5% by 2035 is a powerful statement. It fundamentally changes our standing from a reliable but underweight partner to a true pillar of the alliance. But the most profound effect is the reduction of dependency. The strategy explicitly notes that 69% of our defense exports already go to the U.S. and other Five Eyes partners. By building our own defense industrial base, we ensure we are never again hostage to the political or production decisions of another country, even a close ally. It allows us to secure our own interests first, which in turn makes us a much stronger and more self-reliant partner for everyone else.

What is your forecast for Canada’s defense industrial base over the next decade?

My forecast is one of radical and rapid transformation. For decades, our defense industry has been capable but boutique. Over the next ten years, driven by a massive C$80 billion injection over the next five years and a clear “Buy Canadian” mandate, it will be forced to scale up at an unprecedented rate. We’ll see consolidation around the chosen “defense champions” and a flourishing of smaller, innovative firms in their supply chains, particularly in high-tech areas like AI and quantum. The biggest challenge will be managing this explosive growth—finding the skilled labor, avoiding bottlenecks, and ensuring the investment translates into real capability. If successful, Canada won’t just be a consumer of defense technology; it will be a major-league producer and innovator.