With the dramatic capture of Venezuela’s strongman leader now a settled fact of history, the United States administration has found itself navigating a delicate geopolitical crossroads where the ideals of democratic restoration clash directly with the pragmatic demands of the global energy market. This pivotal moment has forced a critical choice: either commit to the arduous and lengthy process of rebuilding a nation’s fractured political institutions or prioritize a rapid revival of its dormant oil industry to alleviate economic pressures on American consumers. The path chosen by Washington reverberates far beyond the Caribbean, carrying profound implications for international policy, corporate investment, and the price of gasoline for millions.

After the Fall: A New American Playbook

In the aftermath of the Maduro regime’s collapse, the U.S. has outlined a strategy that balances immediate stabilization with long-term democratic goals. The official position supports a patient, 18-to-24-month transitional period leading to free and fair elections, a timeline aimed at allowing political and civil institutions to recover. This approach is intended to prevent a power vacuum and foster a sustainable democratic framework, working alongside the acting president, Delcy Rodríguez, and other figures from the former government to maintain a semblance of state function and order during the fragile transition.

However, this public commitment to a measured political process runs parallel to a more urgent, economically driven objective championed by President Trump. The administration’s clear secondary goal is to restart the flow of Venezuelan crude, leveraging the nation’s vast reserves—among the largest on the planet—to increase global supply and drive down energy prices back home. This dual focus creates a complex dynamic, where the long-term health of Venezuelan democracy is weighed against the short-term economic benefits for American households, a calculation with significant political stakes.

Why Venezuela’s Future Matters at the Gas Station

The strategic maneuvering in Caracas is not merely an abstract foreign policy exercise; it has a direct and tangible connection to the wallets of American consumers. The Trump administration’s policy in a post-Maduro Venezuela is explicitly designed to influence the price paid at the pump. By seeking to reintegrate one of the world’s most significant oil sources into the global market, the White House aims to create downward pressure on fuel costs, a move positioned as a key deliverable for voters ahead of the critical midterm election cycle.

This consumer-centric energy policy transforms Venezuela’s political fate into a domestic economic issue. The success or failure of the administration’s initiative to revive the nation’s oil sector could become a defining factor in the political narrative, with every fluctuation in crude prices potentially swaying public opinion. The fate of Venezuela’s oil reserves is thus inextricably linked to the economic anxieties of the American electorate, making the stabilization of its energy industry a high-stakes political imperative for the current administration.

Dissecting the Dual Pronged Strategy

At the heart of the U.S. strategy lies a fundamental tension between its publicly stated vow and the president’s primary goal. Officially, the administration, through representatives like Energy Secretary Wright and Secretary of State Marco Rubio, advocates for a cautious, methodical transition to democracy. Yet, President Trump has made it unmistakably clear that his main objective is the swift revitalization of Venezuela’s oil production to lower U.S. energy prices. This has created a two-track policy where diplomatic efforts to support a new government are intrinsically linked to the commercial imperative of getting Venezuelan crude back on the market.

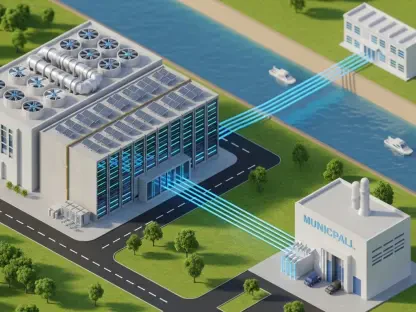

The primary roadblock to this objective is the condition of Petróleos de Venezuela (PdVSA), the state-run oil company. Once a respected and professionally managed industry leader, decades of corruption, mismanagement, and political cronyism have left it in a state of near-total collapse. Its infrastructure is crumbling and its operational capacity is a shadow of its former self, making it an untenable partner for the international investment required for any meaningful recovery. Because current Venezuelan law mandates partnership with PdVSA, the company’s decrepitude stands as the single largest barrier to unlocking the nation’s oil wealth.

Consequently, wooing cautious capital has become a central challenge. Despite the administration’s encouragement, major international energy firms like Exxon Mobil have expressed deep skepticism. The interim Venezuelan government has rushed to amend its oil laws, offering foreign companies greater operational control and more favorable financial terms as a “gesture of improvement.” However, industry leaders are demanding far more than gestures. They require ironclad legal protections, including clear ownership rights over assets and access to neutral international courts for arbitration, before they will consider committing the billions of dollars needed to rebuild a high-risk, unstable sector.

Voices from the Field: On Skepticism and Self Interest

The administration’s push has not been without its critics, particularly from within the domestic energy sector. American oil and gas producers, fearing that a new flood of Venezuelan oil will depress global prices and harm their bottom line, have voiced their concerns to Republican allies in Congress. U.S. Energy Secretary Wright has publicly dismissed these complaints, framing them as an inevitable outcome of market dynamics. He champions this increased competition as “the beauty of capitalism,” arguing that it forces domestic producers to innovate and become more efficient, ultimately benefiting the broader economy.

This sentiment is not universally shared in corporate boardrooms. Exxon Mobil CEO Darren Woods has become a prominent voice for the industry’s cautious stance, publicly highlighting the immense financial and political risks associated with investing in a “still-unstable country.” His perspective reflects a wider industry consensus that significant, fundamental structural reforms must precede any large-scale capital injection. Without a stable political environment and a reliable legal framework, the potential rewards of Venezuelan oil are seen as being outweighed by the peril of losing massive investments to future political turmoil or expropriation.

In response, Secretary Wright has reframed the administration’s entire energy doctrine as a “consumer-first” crusade. He argues that the policy is designed to help the “99 percent of Americans” by maximizing global production to lower prices, even if it creates tougher business conditions for domestic oil companies. This narrative directly contrasts the administration’s approach with that of its predecessor, which Wright claims prioritized a transition away from fossil fuels that led to higher profits for energy companies and higher costs for consumers. This positioning serves to justify the Venezuelan initiative as a pro-voter policy aimed at delivering tangible economic relief.

The Administration’s Blueprint for Balancing Politics and Petroleum

The White House has developed a clear, four-step blueprint to manage its competing priorities in Venezuela. The first step involves political stabilization, which requires working closely with the acting president and remnants of the former government to prevent a total collapse of state institutions. The goal is to maintain basic order and create a functional-enough environment to proceed with economic and political reforms, averting the chaos that would scare off any potential investors and derail the entire initiative.

Next, the administration has focused on laying the legal groundwork for foreign investment. This involves publicly supporting and praising the interim Venezuelan government’s efforts to amend its hydrocarbon laws. By encouraging changes that grant foreign firms greater control over their operations and cash flow, the U.S. hopes to build initial confidence among international energy companies and signal that the country is genuinely open for business under new, more reliable terms.

The third and most complex step is tackling the state-owned giant, PdVSA. Secretary Wright’s diplomatic visit was designed to initiate a “dialogue” on the future leadership and management of the crippled company. The long-term objective is to oversee its transformation from a corrupt and inefficient state apparatus into a viable, transparent, and creditworthy partner for the multinational corporations whose capital and expertise are essential for rebuilding the sector. This process is expected to be contentious and lengthy, requiring deep structural and cultural changes within the organization.

Finally, the administration is actively working to win the narrative at home. Recognizing the opposition from domestic energy producers, the White House has strategically framed its Venezuelan policy as a direct benefit to American voters through lower energy costs. This messaging is crucial for building and maintaining public support, especially with midterm elections on the horizon. By positioning the revival of Venezuelan oil as a key component of its plan to combat inflation and reduce household expenses, the administration aimed to counter industry criticism and secure a political victory. The intricate dance between fostering a foreign democracy and securing domestic energy interests defined a complex chapter in American foreign policy, one where the outcomes at the Venezuelan oil field were directly tied to the results at the American ballot box.