A seemingly minor policy proposal to add a five-dollar monthly fee to otherwise free health insurance plans has become the epicenter of a profound debate over the future of American healthcare affordability. The issue, whether Affordable Care Act (ACA) plans should have a minimum premium, pits the goal of universal access against concerns for program integrity, with millions of low-income Americans caught in the balance. This discussion brings together insights from policymakers, health policy analysts, and advocacy groups to dissect a conflict that will define the next chapter of the ACA.

The Zero-Premium Question: Setting the Stage for a High-Stakes Healthcare Debate

The proliferation of zero-premium health plans on the ACA marketplace is a direct result of enhanced federal subsidies enacted in recent years. These subsidies effectively eliminated monthly payments for millions of lower-income enrollees, a development celebrated by access advocates as a landmark achievement. However, with the legislative mandate to extend these subsidies now on the table, what was once a straightforward benefit has become a contentious point of negotiation. The impending deadline has forced a national conversation about the very structure of this financial assistance.

At its core, the debate reveals a fundamental ideological clash. On one side, proponents of the current system argue that completely free plans are the only way to ensure the most economically vulnerable Americans can gain and maintain coverage. On the other, critics contend that a nominal premium is necessary to ensure enrollees are actively engaged and to curb potential fraud within the system. This conflict places the immediate needs of individuals against broader concerns about the program’s long-term fiscal health and sustainability.

Deconstructing the Core Arguments Shaping the Future of ACA Affordability

The Unseen Barriers: Why ‘Free’ Is Essential for Continuous Coverage

From the perspective of many Democratic lawmakers and patient advocates, even a nominal premium of a few dollars per month represents a significant obstacle to continuous coverage. Their argument is that for individuals earning just above the federal poverty level, an extra annual expense of sixty dollars is not a trivial amount. It can be the difference between paying for medication, groceries, or an insurance premium. This financial strain is seen as a direct barrier to accessing necessary healthcare.

This position is reinforced by academic research and real-world data. A notable study from Massachusetts, for example, revealed that when its state marketplace shifted plans from having no premium to a very low one, enrollment subsequently dropped by 14 percent. Health policy experts also point to the “hassle factor”—an administrative barrier that disproportionately affects at-risk populations. Many low-income individuals may not have bank accounts or credit cards for easy electronic payments, making the process of paying a monthly bill a significant hurdle that can lead to unintentional coverage loss.

A Price for Participation: The Argument for Enrollee ‘Skin in the Game’

In contrast, some Republican policymakers propose a minimum premium as a necessary tool for ensuring program integrity and responsible participation. Their central concern revolves around the concept of “phantom enrollees”—individuals signed up for coverage, often without their knowledge, by brokers or insurers looking to collect federal subsidies. The argument is that since no bill is ever sent for a zero-premium plan, the enrollee may be completely unaware of their coverage, creating an environment ripe for fraud.

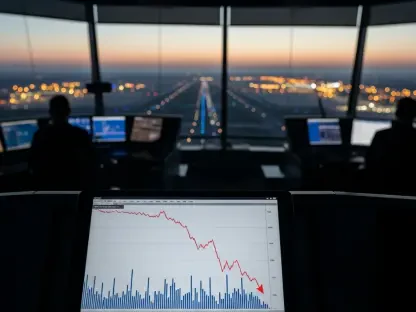

This viewpoint is supported by analysis from conservative think tanks, which highlight a sharp increase in the number of ACA subscribers who have filed no medical claims over a full year, rising from 20% to 35% in just three years. According to this school of thought, requiring a small financial contribution—a price for participation—establishes a tangible connection between the enrollee and their health plan. This “skin in the game” is believed to foster a sense of ownership, reduce the likelihood of fraudulent enrollments, and ensure that those receiving benefits are active and willing participants in their own healthcare.

Navigating the Political Minefield: The Battle for a Bipartisan Compromise

The legislative path to a resolution is fraught with political complexities. While a clean, three-year extension of the enhanced subsidies passed the House with notable bipartisan support, its journey through the Senate has stalled. Bipartisan negotiations, led by key figures like Senators Moreno and Collins, have been unable to bridge the divide on the minimum premium question. This has created a high-stakes standoff where the future of subsidies for millions hangs in the balance.

The strong House vote has emboldened progressives, who now feel they have significant political leverage to resist any concessions on the no-premium structure. They are urging Senate leadership to hold a firm line, viewing the Republican proposal as an unnecessary barrier to care. The negotiations are further complicated by the introduction of other contentious policy riders and the pressure of a looming congressional recess, which threatens to delay a decision and create uncertainty for enrollees planning for the next coverage year.

A Tale of Two Systems: The Disproportionate Impact on Non-Medicaid Expansion States

The debate over a minimum premium carries disproportionately high stakes in the 10 states that have not expanded Medicaid under the ACA. In these states, zero-premium marketplace plans serve as a critical safety net for a large population of very low-income individuals who would be covered by Medicaid elsewhere. For those earning between 100% and 150% of the federal poverty level, these plans are often the only pathway to affordable health insurance.

Eliminating this no-cost option would inflict a particularly harsh blow on residents in states like Georgia and Wisconsin. Lawmakers from these regions, such as Senator Warnock, have been vocal in highlighting this disparity, arguing that a uniform minimum premium policy would ignore the unique circumstances of their constituents. To quantify this threat, Senator Warnock has formally requested an estimate from the Congressional Budget Office to project the exact number of individuals who could lose their coverage in these specific states if a minimum premium were to be implemented.

From Debate to Decision: Key Considerations for Policymakers and Stakeholders

The ongoing discussion synthesizes a core dilemma in health policy: how to balance the imperative of maximizing access for vulnerable populations with the need to ensure fiscal integrity and responsible program management. The path forward requires moving beyond entrenched positions to consider nuanced solutions that can address the valid concerns of both sides. This means acknowledging that while a premium can be a barrier, the potential for fraud, however debated, cannot be ignored.

Several policy alternatives could offer a middle ground. Instead of a universal premium, lawmakers could explore income-based premium floors, where only those above a certain poverty threshold contribute. Another approach involves investing in more sophisticated, targeted fraud detection technologies that do not penalize legitimate enrollees. For citizens, advocates, and providers, understanding these policy levers is crucial for engaging constructively in a legislative process that will have far-reaching consequences for the nation’s healthcare landscape.

The Final Verdict: Defining the Next Era of American Healthcare Access

The resolution of the minimum premium debate was a watershed moment that directly shaped the affordability and accessibility of health insurance for millions of Americans. The decision made by lawmakers either solidified a foundational tenet of the ACA—that cost should not be a barrier to coverage for the poorest citizens—or it introduced a new financial hurdle in the name of program integrity.

Ultimately, the outcome underscored the immense challenge of designing policies that reconcile compassionate ideals with the practical realities of managing a massive, complex system. It served as a powerful reminder that in the world of healthcare, even the smallest financial requirements can have profound and lasting impacts on the lives of the nation’s most vulnerable populations.