The seismic tremors of a high-stakes confrontation between the Trump administration and the health insurance industry have suddenly quieted, replaced by the carefully calibrated hum of legislative maneuvering. This abrupt shift from public threats to political proposals marks a pivotal moment in U.S. healthcare policy, where the volatile mix of executive strategy, industry stability, and consumer costs creates an environment of profound uncertainty. The affordability of healthcare for millions of Americans hangs in the balance, shaped not by grand bipartisan compromise but by the immediate pressures of a politically charged landscape. This analysis will dissect the administration’s strategic pivot from direct confrontation to legislative action, examine the industry’s calculated response, and forecast the future of a political-industrial dynamic defined by temporary truces and lingering tension.

The Strategic Pivot: From Confrontation to Legislation

The recent change in the administration’s approach toward the health insurance industry represents a significant tactical evolution. What began as a period of intense anxiety for insurers, marked by the looming threat of an executive-led pricing crackdown, has transformed into a more predictable, albeit still challenging, legislative process. This move signals a recognition of political realities and the inherent difficulties in imposing sweeping changes through executive order alone, offering a case study in de-escalation that has reshaped the immediate future of healthcare policy debates.

Shifting Tactics and Political Realities

The administration’s initial posture was one of direct confrontation, with rhetoric pointing toward a severe crackdown on industry pricing and profits. This aggressive stance sent shockwaves through the sector, which braced for direct executive action. However, the recently unveiled “Great Healthcare Plan” signaled a dramatic change in direction. Instead of unilateral mandates, the administration has opted for a legislative route, effectively trading a swift executive strike for a protracted congressional debate.

A key example of the administration’s more targeted, yet limited, pressure can be seen in its recent proposal for Medicare Advantage plans. The move to implement an “essentially flat pay increase” for these plans in 2027 was a pointed measure that fell short of the all-out war the industry had feared. This decision underscores a more nuanced strategy, applying pressure at specific points rather than attempting to overhaul the entire system by fiat. This evolving approach is also driven by a pressing political context: with pandemic-era tax credits expiring, millions of Americans are facing sharply rising Obamacare premiums, creating an urgent need for the administration to demonstrate action on healthcare affordability.

The Great Healthcare Plan as a Case Study in De-escalation

The “Great Healthcare Plan” serves as a concrete example of this strategic shift away from direct confrontation. Its core pillars focus on legislative changes, including enhanced price transparency requirements, the expansion of tax-advantaged Health Savings Accounts (HSAs), and a heavy emphasis on targeting high drug and hospital costs. By framing the solution within a legislative package, the administration provides the insurance industry with a significant, if temporary, reprieve from the threat of immediate executive action. This pivot effectively transfers the battleground from the White House to the halls of Congress, an arena where industry lobbyists are well-equipped to navigate and influence outcomes.

The industry’s public relations response has been meticulously managed to align with this new landscape. The trade group America’s Health Insurance Plans (AHIP) was quick to praise the plan, highlighting its focus on drug prices and framing it as a constructive step toward greater affordability. This public endorsement illustrates a sophisticated strategy to navigate the changing political winds, embracing a less threatening proposal to deflect the more damaging alternatives that were once on the table. For insurers, the plan is not just a policy proposal; it is a welcome de-escalation in a high-stakes political conflict.

Voices from the Inside: Expert and Industry Perspectives

A White House official characterized the legislative approach not as a retreat but as a “very thoughtful” strategy designed to foster collaborative reform. This framing suggests a deliberate choice to work through established channels rather than impose top-down mandates, portraying the administration as a facilitator of systemic change rather than an antagonist to a single industry. The goal, from this perspective, is to build a more sustainable solution by engaging stakeholders in a legislative process, even if that process is fraught with partisan gridlock.

This official narrative stands in stark contrast to the initial sentiment within the industry. One source close to the White House bluntly stated that insurance companies “were definitely shitting themselves,” a comment that captures the genuine fear of a direct and punitive executive crackdown. That palpable anxiety has since subsided, replaced by a sense of cautious relief. While the immediate threat has been neutralized, industry insiders understand that the reprieve may be temporary, contingent on a president known for his political volatility.

Policy experts, meanwhile, view this strategic shift as a clear victory for insurers, largely due to the realities of a divided government. Cynthia Cox of KFF, a non-profit organization focused on health policy, argues there is “no political pathway” for major healthcare legislation to pass, especially in the current political climate. This legislative stalemate effectively preserves the status quo, which is a favorable outcome for insurers who benefit from legislative inaction.

However, this view is not universally shared within Republican circles. Dissenting strategists like Joel White are advocating for a much more aggressive stance, urging the administration to use its existing executive authority to break up large insurance companies and prohibit them from owning physician practices and pharmacies. This internal debate highlights the lingering political risk for the industry, as a faction within the president’s own party continues to push for the very confrontation that insurers have, for now, managed to avoid.

The Road Ahead: Future Implications and Lingering Tensions

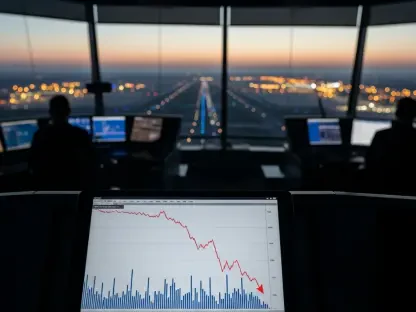

The future of this trend now hinges on a transition from the executive branch to a gridlocked Congress, creating a new battlefield where industry lobbyists can leverage their considerable influence. The high probability of legislative stalemate benefits insurers in the short term, as it prevents the passage of any restrictive new laws. However, this environment is not without risk. The possibility remains that President Trump, frustrated by a lack of congressional action, could revisit the issue and re-engage in direct confrontation for political effect.

The primary challenge for insurers is navigating the profound uncertainty of this political landscape. They must contend with a president known for his volatility while simultaneously managing the ongoing pressure from factions within the Republican party demanding a tougher stance on healthcare costs. This dynamic forces the industry to engage in a delicate balancing act, publicly supporting collaborative efforts while privately preparing for the potential return of a more adversarial approach.

Ultimately, this trend reveals how deeply U.S. healthcare policy has become entwined with short-term electoral politics and presidential temperament. Rather than being shaped by long-term strategic planning, the industry’s operating environment is subject to abrupt shifts in political winds. This creates a perpetually unstable climate where business strategy must be as much about political risk management as it is about market dynamics, with significant implications for the cost and accessibility of care for all Americans.

Conclusion: A Temporary Truce in a Protracted War

The Trump administration’s strategic shift from direct threats to a legislative proposal had granted the health insurance industry a significant but temporary reprieve. This pivot, driven by political realities and tactical recalculations, effectively moved the conflict over healthcare costs from the Oval Office to the halls of Congress, an arena far more favorable to the industry. The interplay between this high-stakes political strategy and the economics of healthcare directly impacted the financial stability and operational certainty of a sector that serves millions of Americans. While insurers had successfully dodged a bullet, the truce remained fragile. The industry understood that this was just one battle in a protracted war over healthcare costs, and it had to remain prepared for the next political skirmish on the horizon.