Setting the Stage for Transformative Oversight

Imagine a financial world where algorithms decide loan approvals in seconds, yet unknowingly perpetuate bias against certain demographics, leaving consumers vulnerable and markets unstable. This scenario is no longer a distant concern but a pressing reality as artificial intelligence (AI) reshapes the financial services landscape. With AI driving critical decisions from credit scoring to fraud detection, the reintroduction of a pivotal bill by a senator to regulate its use marks a defining moment for the industry. This market analysis delves into the implications of this legislative push, exploring current trends, potential impacts, and future projections for financial services under tighter AI governance. The urgency to balance innovation with accountability has never been clearer, as stakeholders across the sector brace for a regulatory shift that could redefine operational norms and consumer trust.

Unpacking Market Trends in AI-Driven Finance

The Surge of AI Adoption and Emerging Risks

The financial services sector has witnessed an unprecedented surge in AI adoption, with automated systems now integral to risk assessment, customer service, and investment strategies. Machine learning models process vast datasets to predict market trends, while chatbots handle millions of customer inquiries daily, slashing operational costs. However, this rapid integration has unearthed significant risks, including algorithmic bias that can skew lending decisions and opaque systems that obscure accountability. Market data suggests that over 70% of major financial institutions now rely on AI for core functions, yet a growing number of consumer complaints highlight unfair outcomes tied to these technologies. Without regulatory guardrails, such issues threaten not only individual livelihoods but also systemic stability in a sector that underpins global economies.

Legislative Momentum as a Market Disruptor

The reintroduction of this AI regulation bill emerges as a potential disruptor in the financial services market, signaling a shift toward stricter oversight. While specific details of the legislation remain under wraps, industry analysts anticipate mandates for transparency in AI decision-making and regular audits to detect bias. This legislative momentum reflects a broader trend of government intervention in tech-heavy sectors, driven by public demand for fairness and data protection. Financial firms, especially those heavily invested in AI, may face short-term compliance costs, with projections estimating a 10-15% increase in operational budgets for mid-sized banks over the next two years to align with potential new rules. Yet, this could also spur a competitive edge for firms that adapt swiftly, positioning themselves as leaders in ethical technology use.

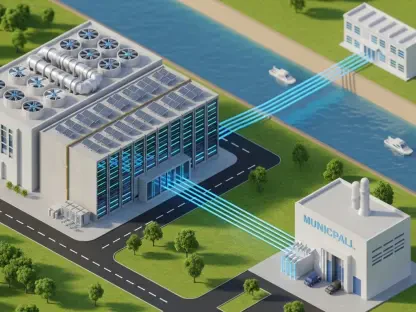

Privacy and Data Security as Market Pain Points

Beyond ethics, privacy and data security stand out as critical pain points shaping market dynamics in AI-driven finance. Financial institutions handle sensitive personal information, making them prime targets for cyber threats amplified by AI misuse. Regional disparities in privacy regulations, such as varying state laws under frameworks like the California Consumer Privacy Act, complicate compliance for firms operating nationwide. Market forecasts indicate that data breaches in the sector could cost upwards of $5 billion annually by 2027 if unchecked, pushing firms to invest heavily in secure AI systems. The proposed bill is expected to address these concerns with stringent data protection standards, potentially reshaping how companies prioritize cybersecurity in their strategic planning.

Projecting the Future of Financial Services Under AI Regulation

Evolving Technologies and Regulatory Challenges

Looking ahead, the financial services market is poised for further transformation as emerging AI technologies like real-time trading algorithms and blockchain integration gain traction. These innovations promise enhanced efficiency but also introduce complex regulatory challenges that could outpace current legislative frameworks. Analysts predict that adaptive policies will be essential, with the proposed bill potentially serving as a blueprint for dynamic governance that evolves alongside tech advancements. Over the next few years, from 2025 to 2027, the market may see a 20% uptick in AI-specific compliance tools as firms prepare for stricter oversight, reflecting a proactive shift toward aligning with anticipated legal standards.

Economic Impacts and Workforce Shifts

Another critical projection centers on the economic and workforce implications of AI regulation in finance. Increased automation, while boosting productivity, risks reducing human oversight roles, potentially displacing thousands of jobs in areas like data analysis and customer support. Market studies suggest that regulated AI could temper this displacement by mandating human-in-the-loop systems, preserving a balance between efficiency and accountability. Economically, the sector might experience a temporary slowdown in AI investment as firms navigate regulatory uncertainty, though long-term gains in consumer trust could drive market growth. Smaller institutions, in particular, may struggle with compliance costs, possibly leading to consolidation trends as they merge with larger players for resource support.

Global Convergence and Competitive Positioning

On a broader scale, the trajectory of AI regulation in the U.S. financial sector could influence global markets, fostering a convergence of standards over the coming decade. If this bill sets a robust precedent, it may encourage international alignment on AI governance, impacting how multinational firms operate across borders. Competitive positioning will likely hinge on early adoption of ethical AI practices, with projections showing that firms prioritizing transparency could capture a larger share of privacy-conscious consumers. This global ripple effect underscores the market’s interconnected nature, where a single legislative move can redefine competitive landscapes far beyond national boundaries.

Reflecting on Market Insights and Strategic Pathways

In retrospect, the analysis of the senator’s reintroduced AI bill reveals a financial services market at a crossroads, grappling with the dual forces of technological innovation and regulatory necessity. The examination of current trends highlights the pervasive risks of unchecked AI, from bias to data vulnerabilities, while projections underscore the transformative potential of adaptive policies. For stakeholders, the path forward demands strategic alignment with emerging standards, with financial firms encouraged to invest in transparent AI systems and robust cybersecurity measures. Policymakers face the task of crafting balanced legislation that fosters innovation without compromising consumer protection. As the market continues to evolve, the lasting lesson is clear: proactive adaptation to regulatory shifts is not just a compliance requirement but a cornerstone for sustained growth and trust in an increasingly digital financial ecosystem.