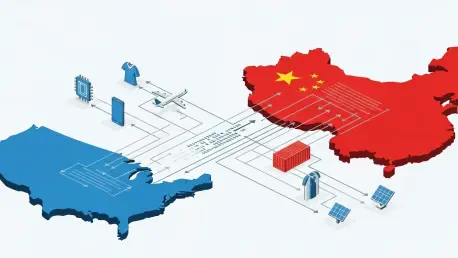

The tectonic plates of global commerce are shifting as the United States aggressively dismantles decades of industrial reliance on Chinese manufacturing in favor of a more resilient, multipolar supply chain. This historic pivot represents far more than a simple trade dispute; it is a fundamental

The quiet, pine-scented air of the North Woods is increasingly vibrating with the hum of high-performance computing as the global thirst for artificial intelligence transforms Maine into an unlikely tech frontier. For decades, the state’s industrial identity was defined by the rhythmic churning of

A dramatic judicial pivot has fundamentally reshaped the landscape of American trade policy, challenging the long-held assumption that the presidency possesses absolute authority over international commerce. When Donald Trump picked conservative justices for the Supreme Court, he likely didn't

The massive, windowless concrete structures that now dominate rural landscapes and suburban industrial parks were once viewed as the shimmering beacons of a new digital gold rush, promising endless economic prosperity. For nearly a decade, state and local governments across the United States

The political landscape in Washington has transformed into a complex arena of high-stakes legal battles and procedural maneuvers as the 118th Congress navigates a turbulent relationship with the executive branch. This friction is not merely a byproduct of partisan disagreement but stems from a

As the leader of Government Curated, Donald Gainsborough operates at the very center of policy and legislation. With a sharp understanding of the forces shaping Washington, he provides a critical perspective on the increasing friction between political agendas and the data-driven world of economic

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44